KKR Saudi Company

Background

KKR Saudi (the “Firm”) is a closed joint stock company established under the Regulations for Companies in the Kingdom of Saudi Arabia, Commercial Registration: 1010340484 Unified CR number: 7001691174, operating under a license from the Saudi Arabian General Investment Authority No. 102832119956 and an Arranging License from the Capital Market Authority No. 11154-10 issued on 26 / 06 / 2011 and received a letter to start Practicing on May 11 2013.

The direct controllers of the Firm are KKR Mena Holdings LLC, a limited liability company established under the laws of Delaware and Kohlberg Kravis Roberts & Co. L.P., a limited liability partnership established under the laws of Delaware.

Under its Arranging License, the Firm performs arranging services by introducing parties in relation to securities business to bring about a deal in a security. Specifically,

- Identifying and arranging investments in Saudi-based companies for KKR funds;

- Arranging partnerships/investments for KKR portfolio companies in Saudi Arabia; and

- Identifying potential institutional investors for KKR managed funds

- Managing Investments and Operating Funds

Paid Up Capital

The Firm has paid up capital in the amount of SAR 20,000,000.

Contact Information

KKR Saudi Company

Faisaliah Tower, Floor 18

Olaya District

P.O. Box 54995

Riyadh 11524

Saudi Arabia

Phone: +966 11 490-3767

Fax: +966 11 490-3768

Unified CR Number: 7001691174

Board of Directors

Christopher Johnson, Chairman, Board of Directors

Christopher Johnson was appointed Non-executive Chairman of the Board by Partners Resolution dated July 8, 2015. Mr. Johnson has been the Managing Attorney at the Al Sharif Law Firm since December 2010 and is responsible aspects of client services in the areas of corporate, litigation, intellectual property, and labor law. Previously, Mr. Johnson served for three years as President of the humanitarian airline AirServ, responsible for programs in some 20 third world countries and for ten years as Chairman of the Vint Hill Economic Development Authority responsible for the redevelopment of a former U.S. Army Base in Northern Virginia.

Mr. Johnson has a BA from Princeton University and Juris Doctorate from New York University. He is licensed to practice in the New York Bar and District of Columbia Bar.

Senior Management

Mohamed Attar - Board Member, CEO and Head of Arranging

Mohamed Attar, Director, joined KKR from Blackrock where he was part of the BlackRock Family Offices and Foundations business in EMEA, responsible for managing the firm's existing relationships with Family Offices in the Middle East as well as developing new ones. Prior to that, he worked at Waha Capital in Abu Dhabi, a publicly-listed investment firm. where he launched Waha's fundraising platform for Capital Markets, focusing on regional investors (Institutions, Family Offices, and Insurance & Investment companies). He worked at Morgan Stanley Investment Management before Waha Capital, where he developed their client network and was responsible for distributing investment management products across all asset classes to regional institutional and family office clients. Mohamed started his career at Barclays Capital, London, dealing in Fixed Income products to Middle Eastern Financial Institutions.

Mohamed holds a Master of Science in Project Management from George Washington University, and a Bachelor of Arts & Science, with a double major in Finance & International Business from Georgetown University's McDonough School of Business in Washington DC.

Rashed AlRashed - Board Member

Rashed AlRashed was appointed as a board member for KKR Saudi in 2022. Mr. AlRashed is a highly accomplished board member with 15 years’ experience in highly regulated industries, an entrepreneur and business leader promoting innovation and creativity in various sectors. Mr. AlRashed developed a deep expertise in identifying, evaluating and mitigating risks as a business advisor to various company’s Board and Senior Management. He has a proven track record of leadership and management competencies, managing multidisciplinary teams across continents. He has led companies through their most important challenges and opportunities, often in complicated and highly visible, regulatory and investor environments relying on a remarkable background in Finance and Business Administration. Mr. AlRashed, Chairman of Hwadi since 2016, successfully navigated Hwadi through the uncertainty of the pandemic, spurring growth despite a very unstable world economy. Following his vision, he guided the company through the crisis, seeing the opportunities for growth in digitization as a core component of his strategy. Hwadi has become a hub and catalyst for technological development, where mobile apps, digital content creation, and virtual or hybrid conferences became an essential part of its services and business activities.

Elizabeth Di Cioccio - Head of Asset Management

Elizabeth Di Cioccio joined KKR Saudi Company in 2023 and is a Head of Asset Management she leads the Firm's client business in the Middle East. Prior to joining KKR, Ms. Di Cioccio was a partner and head of international distribution at Mercury Capital Advisors, where she was based in Dubai and focused on capital raising in the Middle East, parts of Europe, and Australia. She started her career in fundraising in 2005 within Merrill Lynch's fund placement group in London (which later became Mercury Capital Advisors). Ms. Di Cioccio holds a B.A., Phi Beta Kappa, Summa Cum Laude from Middlebury College.

Tamer Elias Samo - Chief Financial Officer

Tamer Elias Samo joined KKR Saudi Company in 2023 as a Chief Financial Officer within the Global Client Solutions Group for KKR Saudi Company.

Prior to joining KKR, Mr. Samo was most recently an Investment Banking Senior Analyst for Ernst and Young Middle East covering the GCC. He helped advise on multiple cross-border M&A transactions including Global Investment House’s sale of JTC to Qurain Petrochemical Industries Corp, Bahamdan Group on the sale of Tashelat to a JV between Saudi Aramco & Total Energies and Havenvest on the sale of Help AG (leading MENA cybersecurity firm) to Etisalat. He started his career on the Transaction Advisory Services team at Ernst & Young where he worked on preparing Due Diligence reports for the Consumer and Education sectors.

Tamer obtained his bachelor’s in business administration with a concentration in Finance & Accounting in addition to a minor in Economics from the American University of Beirut (2016).

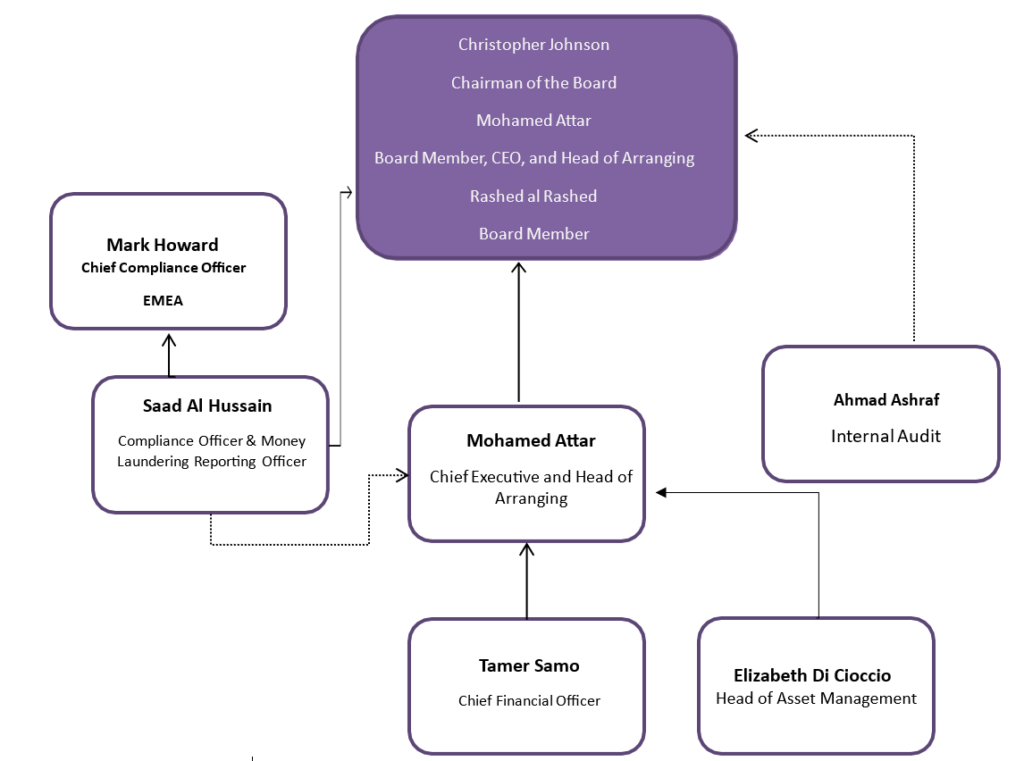

Organization Chart

Audited Financial Statements

Complaints

All complaints must be in writing to the Compliance Officer at [email protected] who will notify the customer that the complaint has been received and the Firm’s procedures for reviewing the complaint.

The Firm will endeavor to resolve complaints within 60 days of receipt. Within 30 days of receiving a complaint, the customer will be sent either: (i) a final response letter, explaining how the Firm intends to resolve the complaint; or (ii) a holding response letter, advising that the matter is still under investigation.

If the complaint is not resolved within 30 days of receipt, then within 60 days of receiving the complaint, the customer will be sent either: (i) a final response letter; or (ii) a further holding response letter, explaining why the matter is still under review with an anticipated timeframe for resolution.

Upon conclusion of the complaint, the Firm will promptly: (i) advise the complainant in writing of the resolution of the complaint; (ii) provide the complainant with clear terms of redress, if applicable; and (iii) comply with the terms of redress if accepted by the complainant.